Sales of Goods Act Malaysia

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Licensed Manufacturing Warehouse LMW is a warehouse license under the provision of section 6565A of the Customs Act 1967 Malaysia.

It aims to protect consumers against poor-quality products and unfair business practices or contract terms with regards to transactions repairs refunds and delivery.

. Meaning of manufacture Part II ADMINISTRATION 4. A consumer is defined as an individual. Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

Its purpose was to replace the sales and service tax which has been used in the country for several decades. It is worth noting that Malaysias household debts rose to RM1375 trillion as at end-2021 from RM127 trillion in 2020. While most judgments for the payment of a debt cannot be enforced by way of an order for committal the non-compliance of some judgements which provide for the doing of certain actions such as the delivery of post-dated.

LAWS OF MALAYSIA Act 806 SALES TAX ACT 2018 ARRANGEMENT OF SECTIONS Part I PRELIMINARY Section 1. That meant only manufacturers and importers were under the jurisdiction of the finance minister. 12 DECEMBER 2017 DISPOSAL OF PLANT OR MACHINERY PART I - OTHER THAN CONTROL LED SALES PUBLIC RULING NO.

A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer. Functions and powers of Director General and other officers 5. Under the Goods and Services Tax registered dealers must file their GST returns with details regarding their purchases sales input tax credit and output GST.

INLAND REVENUE BOARD OF MALAYSIA DISPOSAL OF PLANT OR MACHINERY PART I OTHER THAN CONTROLLED. The amendment to Section 106 2 means that sellers would come under the ministers jurisdiction to make regulations over registration. It is essential that the seller should be in.

This amendment is effective from 01 st February 2019. The Bill for an Act with this short title will have been known as a Sale of Goods Bill during its passage through Parliament. The above amendment act has included HSS in the activities which are not to be treated as supply under GST.

AGENCY Browse other government agencies and NGOs websites from the list. It is only applicable in judgment which orders a person to do an act or refrain from doing an act typically within a specified time period. EVENT CALENDAR Check out whats happening.

COMPLAINT. The purpose of LMW is to give Customs duty exemption to all raw materials components and machinery and equipment used directly in the manufacturing process of approved produce from the first stage of. Similarly taxpayers supplying exempted goods or exempted services under GST need to issue a bill of supply in place of a tax invoice.

To calculate taxable goods imported into Malaysia add up the value of the goods freight costs insurance the. Strategic Trade Act is an Act to provide for control over the export transshipment transit and brokering of strategic items including arms and related material and other activities that will or may facilitate the design development and production of weapons of mass destruction and their delivery systems and to provide for other matters connected therewith consistent with. Recognition of office 7.

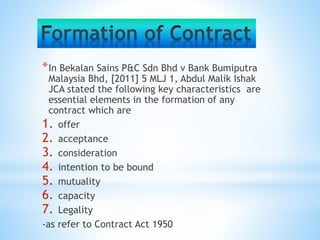

The Ministry of Finance MoF is leading the initiative to regulate the industry and the CCA will be administered by the Consumer Credit Oversight Board CCOB an independent competent authority for consumer credit business set up under the MoF. The imported goods are at times stored in the warehouses before filing the bill of entry for home consumption in the name of buyer. Sale of Goods Acts with variations regulate the sale of goods in several legal jurisdictions including Malaysia New Zealand the United Kingdom and the common law provinces of Canada.

INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text. D Threshold Any person providing taxable services liable to be registered if the total amount of taxable services provided by him in 12 months exceed threshold. Difference between HSS and bond sales.

Businesses are expected to file 2 monthly returns as well as an annual return. The Consumer Rights Act 2015 harmonises the rules regarding the supply of goods services and digital content when the contract is business-to-consumer B2C. Persons appointed or employed to be public servants 6.

Our employees operate a knowledge-based business model and act as route-to-market specialists to provide market information leading product and application expertise marketing sales and logistics expertise and state-of-the-art IT. Our in-depth industry insight and broad local knowledge enable us to offer a complete range of services to help grow the businesses of suppliers. An amendment to the Sales Tax Act passed on Thursday calls for a 10 sales tax to be imposed on imported low-value goods purchased online and delivered to Malaysia by vendors registered with the.

The GST Council has assigned GST rates to different goods and services. Vote for GST Portal performances and view the poll result here. Short title and commencement 2.

While some products can be purchased. Since invoices are needed for purposes ranging from recording sales collecting input credit to protecting a business from fraudulent activities etc these form an indispensable part of your business. Previously the Act imposed sales tax on goods manufactured in Malaysia or imported into the country.

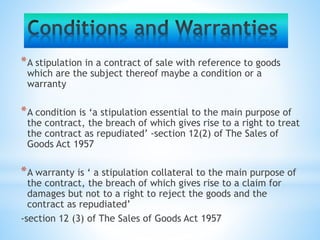

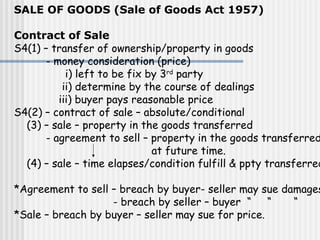

Sale of Goods Acts may be a generic name either for legislation. According to Section 30 Clause 1 of The Sale of Goods Act when seller has sold goods to buyer but the possession of goods remain with him if during that possession seller sold that goods to someone else and that person has purchased goods in good faith and without notice of prior sales he would have good title to them. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

Effective July 16 2018 the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of products. The government is seeking additional revenue to offset its budget deficit and reduce its dependence on revenue from Petronas Malaysias state-owned oil company. The storing is commonly.

The 6 tax will replace a sales-and-service tax of between 515.

Sale Of Goods Act 1957 Sale Of Goods 1 Laws Of Malaysia Reprint Act 382 Sale Of Goods Act 1957 Studocu

No comments for "Sales of Goods Act Malaysia"

Post a Comment